ARB has been trading in a sideways pattern following a rapid rebound from its recent yearly low, and while the asset is currently moving with a relative calm, market dynamics indicate that it may be gathering momentum for a significant move in the near future.

After suffering a major loss earlier this month, ARB managed to find firm support and bounced sharply from its year-long trough. This rebound marked a temporary pause in the prevailing mid-term bearish trend, leaving the market in a state of cautious indecision. Traders are now watching closely, waiting for a catalyst that could determine whether ARB will break out to the upside or slip back into deeper bearish territory.

ARB

Last week, ARB experienced a modest uptick after establishing crucial support at the $0.42 level. However, despite this initial bounce, the asset encountered several hurdles while attempting to recover further, ultimately settling below the $0.5 mark throughout the week. This inability to sustain an upward move suggests that, for now, ARB is in a consolidation phase as it digests recent market volatility.

Throughout this week, the overall trading environment for ARB has remained relatively subdued, primarily due to a noticeable reduction in volatility. The shrinking price swings have led to diminished interest among both traders and investors, resulting in a period of flat trading activity where little significant movement is observed over several days. This stagnation is setting the stage for a pivotal moment: a sudden move—either upward or downward—could decisively determine the token’s next direction.

An upward breakout from the current trading range could reinvigorate market sentiment, sparking increased buying interest and potentially driving ARB higher. In contrast, if ARB fails to maintain its current support levels and experiences another breakdown, it may trigger further bearish action until the asset can secure a more robust foundation.

Key Levels to Watch for ARB

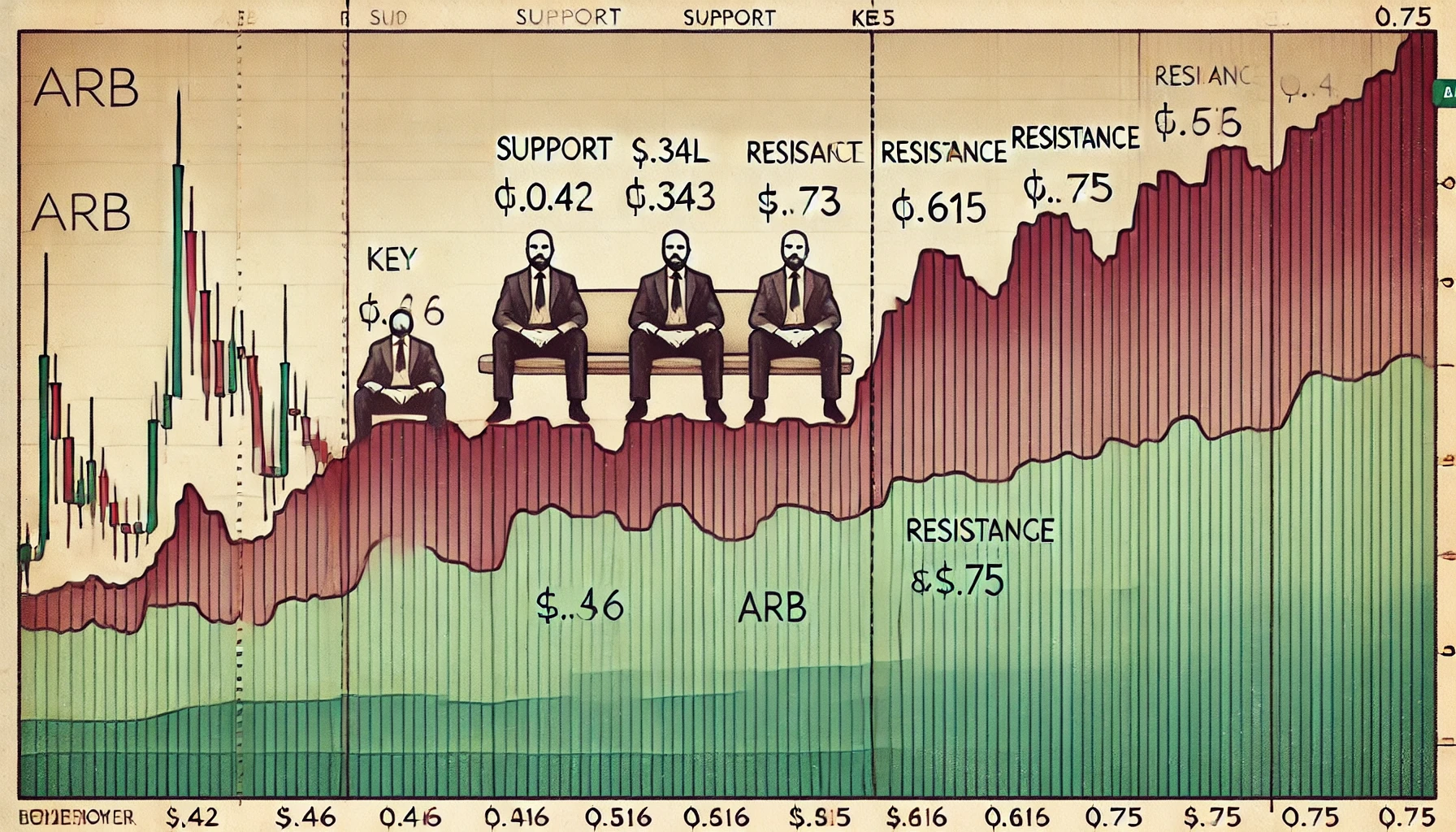

For those monitoring ARB, the next critical resistance level is at $0.516. A daily close above this level could act as a trigger for a more substantial upward move, with projections suggesting that the price might then climb to $0.613, and possibly even reach $0.75 in the short term. Such a breakout would likely signal a reversal of the current consolidation phase and could set the stage for a renewed bullish trend.

On the flip side, if ARB were to slide lower from its current levels, it might breach the support at $0.42. A breakdown past this level would be particularly concerning, as it would force the price to test the next support level at $0.345, which has proven to be a critical floor in previous trading sessions this month. Should ARB fall below $0.345, the price could potentially drop further to around $0.3 before any significant bottoming process begins, thus prolonging the bearish phase.

Key Resistance Levels:

- $0.516

- $0.613

- $0.75

Key Support Levels:

- $0.42

- $0.345

- $0.3

Spot Price: Approximately $0.47

Trend: Bearish, with signs of potential change pending a decisive breakout

Volatility: Moderate, currently trending lower as consolidation continues

The current period of calm might be deceptive, as it is often during such periods of consolidation that the market prepares for its next significant move. A key factor to watch will be any sharp movement away from the current trading range. If the market breaks out upward with strength, it could signal renewed confidence among buyers and lead to a rapid recovery, potentially initiating a bullish run. Conversely, a downward move could further erode confidence, pushing the asset deeper into a bearish retracement.

Disclosure: This is not trading or investment advice. Always conduct your own research before making any investment decisions.

Stay informed on the latest developments in the crypto space by following us on Twitter @nulltxnews, where we bring you up-to-date news on Crypto, NFT, AI, Cybersecurity, Distributed Computing, and the Metaverse.