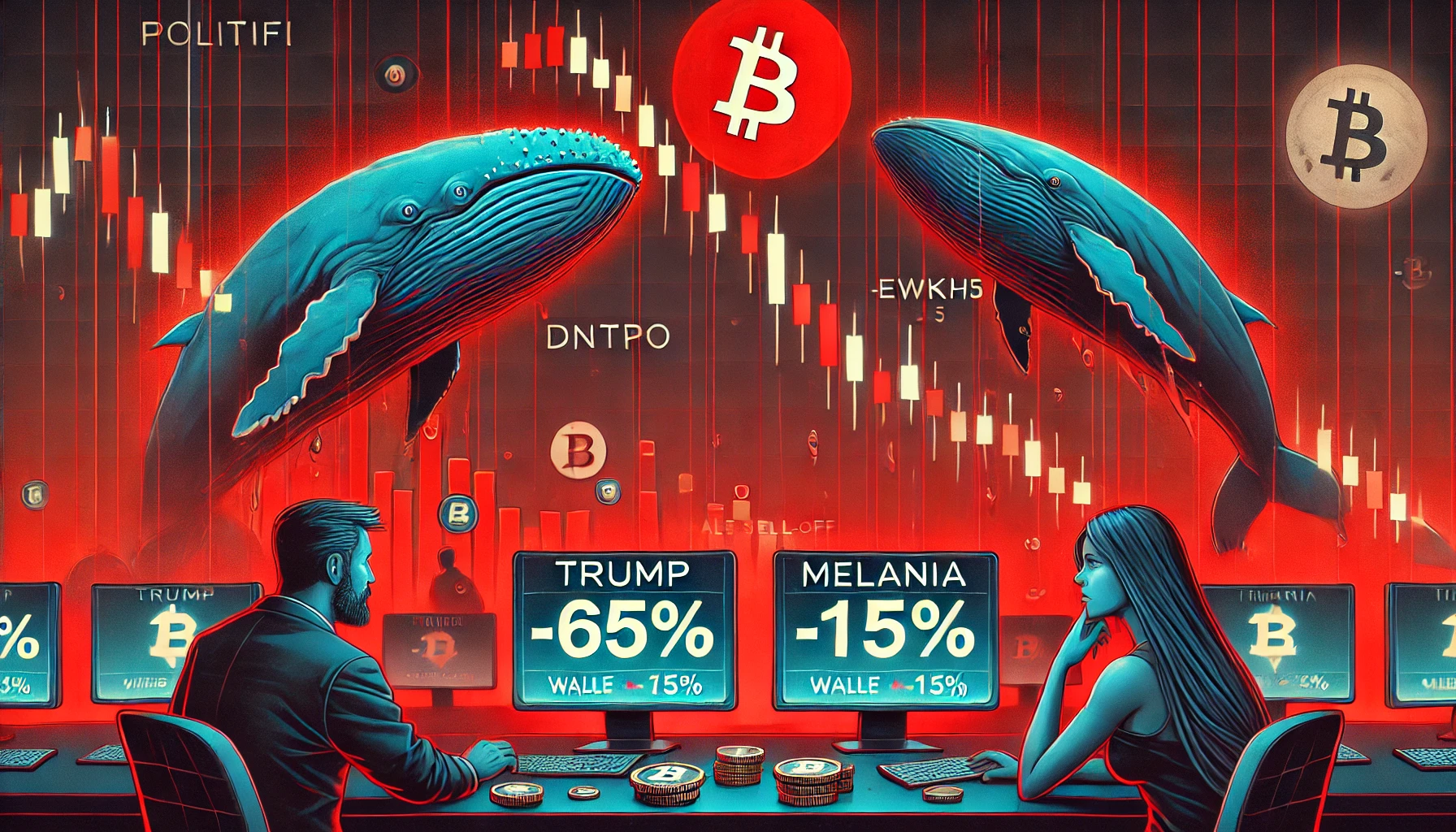

PolitiFi tokens TRUMP & MELANIA faced a significant whale sell-off during a sharp market downturn on Tuesday, sparking concerns about the future of these once-popular cryptocurrencies. Whale activity data reveals that major investors are dumping these tokens at a loss exceeding $14 million, leading to widespread speculation about whether a recovery is possible for PolitiFi’s fallen stars.

Whale Sell-Offs Lead to Over $14M in Losses

According to recent data from Spotonchain on February 25, large-scale investors have been rapidly offloading PolitiFi tokens despite incurring substantial losses. Specifically, whale address “DNTpo” sold 13.98 million MELANIA tokens in exchange for 14.32 million USDC, resulting in a massive loss of $14.9 million (51%) within just one month.

In a similar move, another major investor identified as “EwkH5” offloaded 763,483 TRUMP coins for 9.47 million USDC. This transaction marked a staggering loss of $25.5 million (72%) over roughly the same period.

These sell-offs are particularly alarming given the scale of the losses, suggesting a shift in sentiment among major investors. The magnitude of these transactions has not only impacted the price of TRUMP & MELANIA but also influenced broader market perceptions about the long-term potential of PolitiFi tokens.

TRUMP & MELANIA

What’s Behind the Whale Exodus?

The rapid sell-offs highlight a decline in market confidence for PolitiFi tokens, possibly exacerbated by recent market volatility. Analysts believe that the sell-off was triggered by several factors, including heightened market instability, regulatory developments, and broader economic concerns.

CoinGape recently reported that the cryptocurrency market suffered a significant slump this week, driven by massive liquidations and news surrounding U.S. import tariffs. Bitcoin itself dropped to a $90K low on Tuesday, reflecting the widespread market downturn.

Despite holding their tokens for just a month, whales chose to exit their positions amidst the chaos, likely to avoid further financial losses. TRUMP’s monthly price chart revealed a steep 59% decline, while MELANIA fell by more than 65% during the same period.

The decision to sell at a loss signals not just a loss of confidence but also a strategic move to minimize further losses in a highly volatile market. It also raises questions about the sustainability and growth potential of PolitiFi tokens in the face of changing market dynamics.

Market Performance: TRUMP and MELANIA in Freefall

At the time of writing, MELANIA has experienced a drastic 65% drop over the past 24 hours, trading at $0.9288. The token’s price fluctuated between $0.9197 and $1.24 within the last 24 hours, reflecting heightened volatility.

Meanwhile, TRUMP saw a 15% intraday decline, closing at $12.80. The coin’s 24-hour low and high were recorded at $12.79 and $15.22, respectively. The rapid price decline has caused widespread panic among retail investors, further amplifying the bearish sentiment surrounding these tokens.

Market analysts are skeptical about the short-term prospects of PolitiFi tokens, especially given the scale of whale sell-offs. The massive exit by major investors suggests that the tokens may continue to struggle in the coming weeks.

Investor Sentiment and Future Outlook

The ongoing whale sell-offs have left traders and investors wary of the long-term potential of PolitiFi tokens. Sentiment remains largely bearish, with market participants questioning the likelihood of a price recovery.

Renowned market analyst ‘Vegeta’ recently took to social media platform X, predicting that the Republican-themed coin TRUMP could take several more weeks to stabilize before attempting a rebound. According to his analysis, if the token successfully bottoms out, it could reach a price target of $30-$35. However, he cautioned that investors should be prepared for continued volatility and potential new lows.

CoinGape’s price prediction for TRUMP also aligns with this bearish outlook, highlighting the token’s vulnerability to market pressures. The report suggests that recent trends and economic developments could lead to further price instability, potentially driving more investors to exit their positions.

Is There Hope for Recovery?

Despite the overwhelming bearish sentiment, some analysts believe that the market downturn may present a buying opportunity for risk-tolerant investors. If market conditions stabilize and investor confidence returns, PolitiFi tokens could potentially rebound. However, this remains highly speculative, given the current market landscape.

For now, all eyes are on the whales and their next moves. If major investors continue to offload their holdings, it could signal a prolonged bearish phase for TRUMP & MELANIA. Conversely, if buying interest resurfaces, it might provide the much-needed momentum for a price recovery.

As the market remains on edge, traders and investors are advised to exercise caution and closely monitor whale activity. The future of PolitiFi tokens will largely depend on how market dynamics evolve in the coming weeks.

TRUMP & MELANIA