Market Trends: XRP Tests Key Trendline Support as Breakout Decision Approaches

XRP Faces Critical Trendline Test Amid Shifting Market Trends

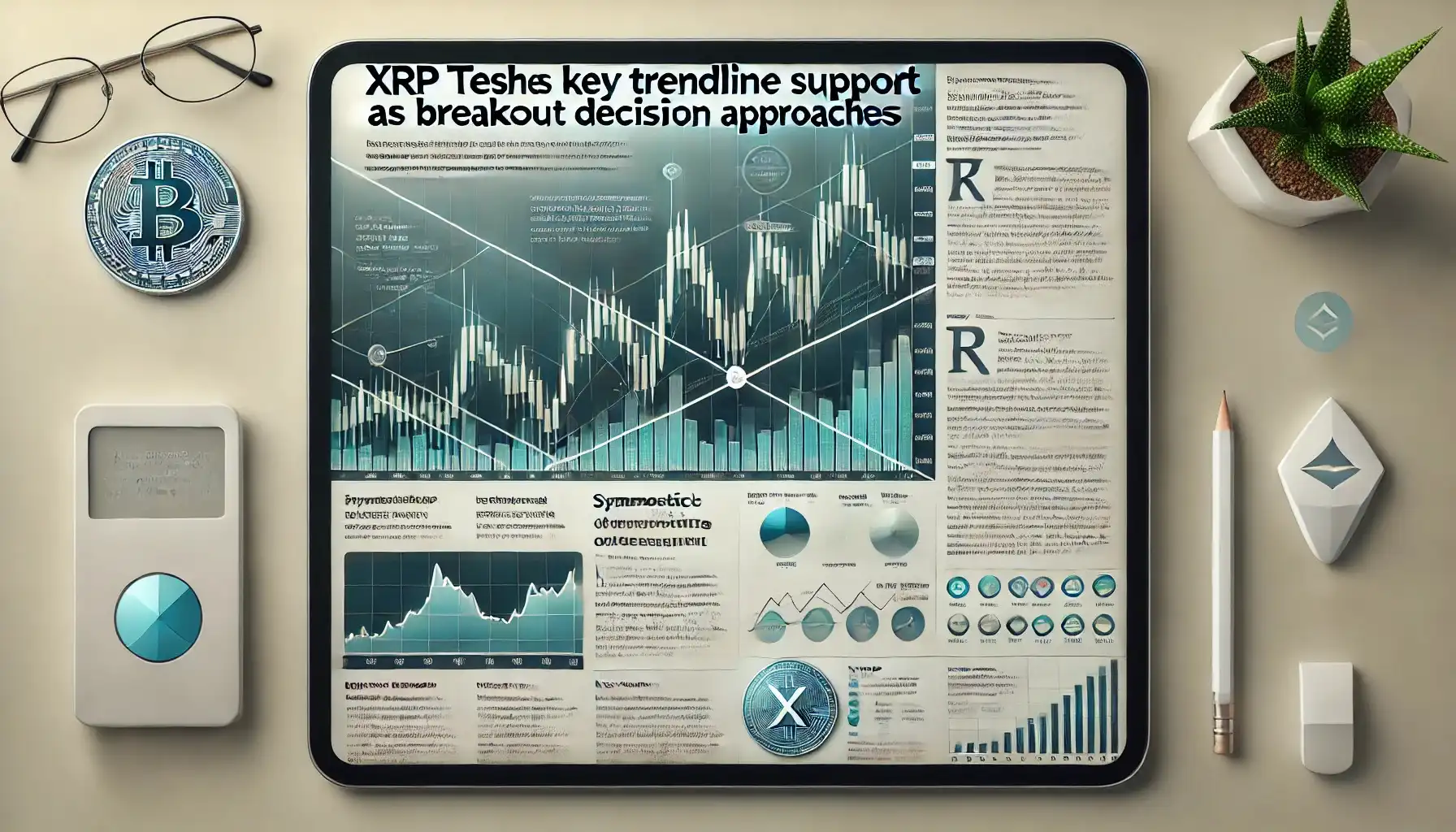

XRP is at a pivotal moment as it tests a key trendline support, reflecting the broader market trends influencing cryptocurrency price movements. As of February 24, 2025, XRP is trading around $2.565, reflecting a 0.54% increase over the past 24 hours. Despite this modest gain, the token remains trapped in a tight trading range, sparking speculation about an impending breakout or breakdown.

According to crypto analyst The Great Mattsby (@matthughes13), XRP is at a crucial juncture, with its price action reflecting a delicate balance between upper resistance and lower support trendlines. This range-bound movement has left traders on edge, eagerly awaiting a decisive move that could shape XRP’s price trajectory in the coming weeks.

With market trends showing increased volatility across the crypto space, XRP’s next move could serve as an important signal for broader altcoin performance in 2025.

XRP’s Price Action Signals an Imminent Breakout Decision

A close analysis of XRP’s price chart reveals that the token has been oscillating within a symmetrical triangle pattern, a classic formation that often precedes a major breakout. The trendlines acting as key boundaries have defined XRP’s movement, preventing extreme swings in either direction.

Recently, XRP dipped below its lower trendline but quickly rebounded, reinforcing the importance of this level as a strong support zone. This suggests that buyers remain active and are keen to defend key price points. However, with only a few days left before XRP reaches the decision point of this pattern, the market is on high alert for the next major move.

The outcome will likely depend on whether XRP can maintain its position above the critical $2.50 support level or if bearish momentum will push it lower toward the $2.00 support zone. Market trends suggest that altcoins, including XRP, could experience heightened volatility, making this a crucial moment for investors and traders alike.

Key Breakout Zone Could Determine XRP’s Future Price Direction

One of the most closely watched areas for XRP traders is the $2.60-$2.75 resistance zone, which serves as a critical breakout point. If XRP can push past $2.75 and hold above this level, it would likely trigger a surge toward the $3.00 resistance, confirming the breakout and signaling the beginning of a strong uptrend.

Historically, market trends indicate that such breakout moves often lead to sustained rallies, particularly in bullish market cycles. If XRP can establish support above $3.00, the next upside target could extend as high as $3.50-$4.00, fueled by increasing investor confidence and market momentum.

Conversely, if XRP fails to break past $2.75, selling pressure could increase, pushing the price down toward the $2.00-$2.20 support region. This level is expected to attract strong buyer interest, as previous dips into this zone have led to swift recoveries. However, if the bearish pressure intensifies, XRP could face further declines, extending losses below $2.00.

Given the current market trends, traders must remain vigilant as the breakout decision nears, as a move in either direction could define XRP’s price action for the foreseeable future.

Market Sentiment Reflects Uncertainty as XRP Tests Critical Levels

As XRP’s price action tightens near key trendline support, the broader market sentiment remains mixed. Traders and analysts are divided on whether XRP will break out to new highs or succumb to selling pressure and retest lower support zones.

Factors Supporting a Bullish Breakout:

- Market Trends Favoring Altcoins – Recent capital inflows into alternative cryptocurrencies suggest growing investor appetite beyond Bitcoin, which could support XRP’s upside momentum.

- Technical Strength of Support Levels – XRP’s ability to hold above $2.50 suggests buyers are stepping in at key levels, preventing further declines.

- Improved Market Sentiment – If XRP surpasses $2.75, the breakout could trigger FOMO (Fear of Missing Out), leading to increased buying pressure.

Factors Supporting a Bearish Breakdown:

- Failure to Break Resistance – If XRP struggles to surpass $2.75, sellers may gain control, leading to a potential retest of $2.00 support.

- Overall Crypto Market Weakness – If Bitcoin and other major assets experience a pullback, XRP could follow suit, delaying any potential uptrend.

- Regulatory Uncertainty – Ongoing discussions regarding XRP’s legal status could impact investor confidence, limiting upside potential.

With market trends shifting rapidly, both long-term holders and short-term traders must stay informed and prepared for potential price swings in the days ahead.

Final Thoughts: Market Trends Dictate XRP’s Next Major Move

As XRP hovers near its trendline support, market trends suggest an imminent breakout or breakdown is approaching. The cryptocurrency’s tight trading range signals that a decisive move is on the horizon, with $2.50 serving as a key support level and $2.75 acting as critical resistance.

Should XRP break above $2.75 and sustain upward momentum, it could trigger a bullish rally toward $3.00 and beyond. Conversely, failure to hold this level could push XRP back toward $2.00-$2.20, where buyers will likely step in to prevent further declines.

The coming days will be crucial, as market sentiment, trading volume, and external catalysts will determine whether XRP embarks on a new uptrend or faces another round of selling pressure. As market trends evolve, traders should stay alert and monitor key technical levels closely.

Will XRP break out to new highs, or will the bears take control? The answer lies in the unfolding market trends.

Website: https://cryptonewsland.com/

Telegram: https://t.me/cryptonewsland